Tom Blake of Moonpig on the need for an agile financial wellbeing strategy

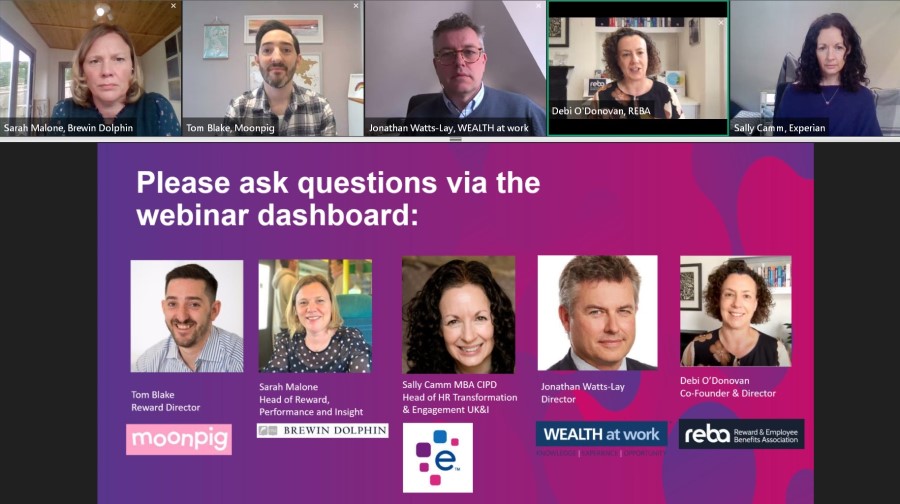

Speaking during REBA’s recent webinar on identifying financial wellbeing needs in a workforce, Tom Blake, interim reward director at Moonpig, describes the importance of understanding what really matters to your organisation.

“The key for me is taking a step back first of all, and thinking about ‘what is it that we want to stand for as an organisation?’” says Blake.

He explains that at Moonpig they’re focused on creating a caring organisation, and although they’ve predominately concentrated on mental wellbeing recently, they have been weaving in elements of financial wellbeing too, given the close relationship between financial wellbeing and mental health.

“My advice to any organisation is to take a step back and work out what it is that you want to do holistically first,” explains Blake.

“Sometimes we can put a load of stuff [products] into the organisation and people forget what’s there, you don’t really get engagement, and if you do too much it becomes too confusing,” he says. “My view is to strip things back as much as you possibly can to really figure out what’s the one, two, or three core things that you want to do really well. This then allows you to be more agile.”

Blake explains that this approach enables employers to fully understand what they want to achieve and the relevant benefits they may want to offer employees. For example, does an employer want to view workplace pensions as simply a passive product on offer to employees, or to encourage colleagues to actively engage with it?

With this understanding in place, you can then move forward with your financial wellbeing strategy, both within a single country, or internationally.

Calling on his experience working at Laird, which has operations in several countries, Blake highlighted that you cannot hope to fully understand the financial situation in each country due to different tax and investment regimes, as well as variations in employees’ financial knowledge.

So again, the key is about understanding what you want to achieve strategically: “When I was at Laird it [the strategy] was very much around our pension, mainly because it was the leading product, but we also wanted to make sure that we had an equitable pension arrangement across our estate. And the way in which you do that depends on the country that you’re in. We ended up having 21 different arrangements because you can’t do the same in every country,” he says.

To round up, Blake added: “Think about what the strategy is – we wanted to provide for our employees long-term, so we started with the pension. The point, particularly with an international lens, is to try and keep it simple.”

For more on this topic, watch the full webinar on identifying financial wellbeing needs in a workforce.

The author is Dawn Lewis, content editor at REBA.