What every reward leader needs to know in 2026 about global benefits compliance

Compliance is no longer just a tick box exercise. For global reward and benefits leaders, it’s becoming a strategic imperative.

With a rising tide of legislation – from evolving gender pay transparency laws in Europe, to new pension mandates in Ireland and localised broker requirements in Brazil – the stakes have never been higher.

The risks aren’t just financial. Missteps can lead to reputational harm, operational disruption, and a loss of employee trust. At the same time, the rules are getting more complex, especially with remote and hybrid work redefining where and how people are employed.

Forward-thinking organisations are staying ahead by combining centralised platforms, expert partners, and transparent communications to protect compliance and unlock competitive advantage.

Here are the three global compliance trends every reward leader needs on their radar in 2026 – and how to respond.

Trend 1: The EU Pay Transparency Directive

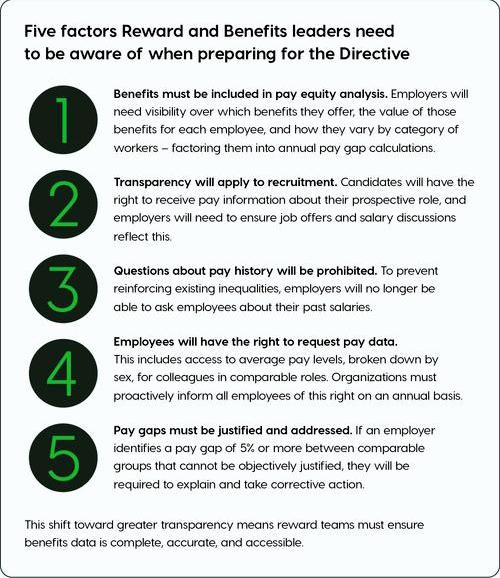

The EU Pay Transparency Directive (EUPTD), set to take effect in 2026, raises the bar for how organisations report on pay – including benefits. It’s not just about base salary.

Employers will need to show the full value of compensation across their workforce and be able to justify any gaps.

This shift toward greater transparency means reward teams must ensure benefits data is complete, accurate, and accessible.

Benifex research found that 44% of UK employers say they’re ready for the EUPTD, and another 46% have a defined plan in place. Among those managing benefits in at least one EU country, 50% say they’re ready and 44% are preparing.

How reward teams are preparing

- Reviewing how total reward is captured and communicated.

- Introducing Total Reward Statements (TRS) to clearly show the full value of employee packages.

- Using tools like TRS 2.0 to visualise pay, stock value and benefits in one place.

- Partnering with organisations like Sysarb to upport pay equity analysis and compliance reporting.

A mindset shift

“We often imagine that pay inequality is the result of someone deciding to discriminate … but most of the time, it’s the outcome of no one asking, no one measuring, and no one challenging assumptions. That’s why transparency matters.” – Kira Marie Peter-Hansen, MEP

“The right question isn’t ‘why should we do this?’ – it’s ‘why not?’” – Konstantinos Karavidas, IKEA

Trend 2. Auto-enrollment in Ireland

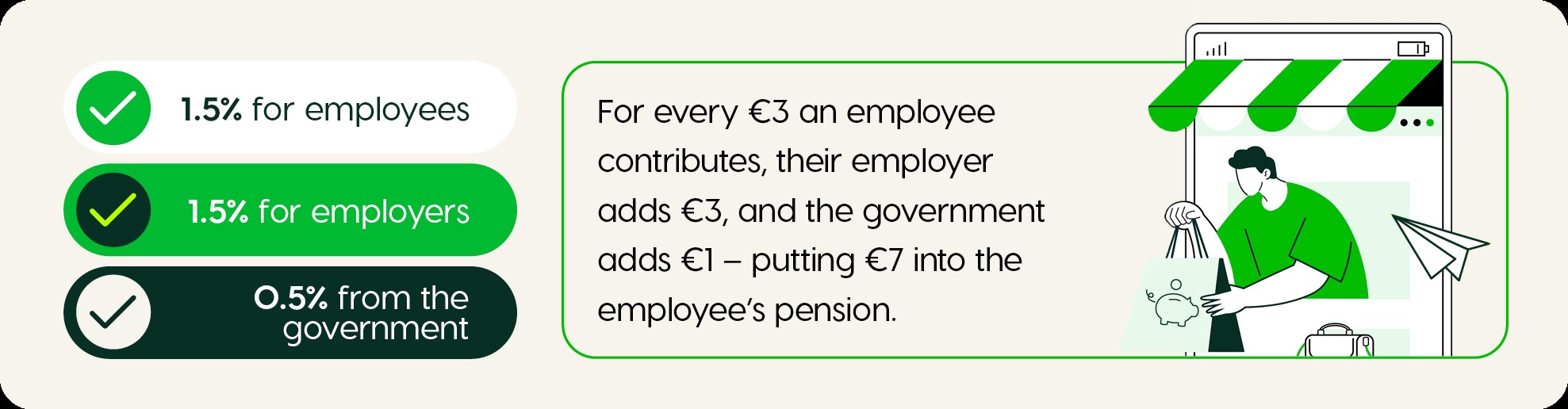

From January 2026, employers in Ireland must automatically enroll eligible employees into a workplace pension plan – with matched contributions and a government top-up.

What to know:

- Applies to employees aged 23–60 earning over €20,000 annually.

- Employers must contribute at the same rate as employees, capped at a €80,000 salary.

Contribution rates will increase incrementally, starting at:

This will bring new administrative and financial compliance challenges – particularly for global employers managing multiple benefits systems across regions.

Takeaway: To stay compliant, organisations must fully understand the new legislative obligations, create a clear compliance plan, work closely with payroll and benefits providers, and roll out a strong communication strategy for employees.

Trend 3: Locally authorised brokers in Brazil

From December 2026, organisations offering insurance-linked benefits In Brazil – like private healthcare, life insurance, or group risk – must work with brokers registered with the Superintendence of Private Insurance (SUSEP), the national insurance regulator.

Why it matters:

- Brazil has one of the most regulated benefits markets in Latin America.

- Local collective bargaining agreements and labor laws (CLT) add complexity.

- Benefits must be clearly worded, fairly structured, and often delivered in local language.

Partnering with a SUSEP-authorised broker helps organisations navigate legal frameworks such as the Consolidation of Labor Laws (CLT) and local collective bargaining agreements.

As well as meeting local requirements, it also help you understand the nuances of Brazil’s benefits landscape – such as food vouchers, transportation allowances, and supplementary pensions.

A note on technology

The law now permits digital signing of contracts, which simplifies processes for organisations using platforms to manage benefits communications and enrollment.

Takeaway: Local partners help global employers balance compliance, cost efficiency, and competitiveness – while offering insight centralised HR teams may not have.

The role of technology in compliance

Global benefits technology play a vital role in helping employers stay ahead of compliance demands.

Benefits include:

- Eliminating manual errors and missed reporting deadlines.

- Automating localizationto deliver region-specific benefits.

- Supporting audit readiness with time-stamped, verifiable data.

Did you know? Organisations save up to £12,240 per 1,000 employees on unnecessary premiums by using global benefits tech to improve oversight and eligibility tracking.

Compliance doesn’t have to be a burden

Regulatory pressure is rising – but it’s also an opportunity.

By approaching compliance proactively, reward leaders can create more consistent, transparent, and trusted benefits experiences for employees across the globe.

Whether you’re preparing for the EU Pay Transparency Directive, Ireland’s pension reform, or new local brokerage requirements in Brazil – the time to act is now.

With the right combination of technology, local expertise, and internal alignment, compliance becomes more than a requirement. It becomes a catalyst for building stronger global reward strategies.

Download Benifex’s Global benefits in practice report for your guide to what’s happening in global benefits – and how to respond.

Supplied by REBA Associate Member, Benifex

The home of award-winning employee benefits, reward, recognition, & communications.