What’s happened to my benefits budget?

For years, the rate of medical inflation sat at circa 6% and then two major events occurred to send it soaring to over 10%- Covid-19 and a major economic crisis.

What if this hadn’t happened?

What if we’d avoided both the Covid-19 driven drop in claims and the subsequent escalation in inflation, and instead had continued to see the historic 6% inflationary factor from February 2020 onwards?

Well, somewhat surprisingly, we would be in much the same position.

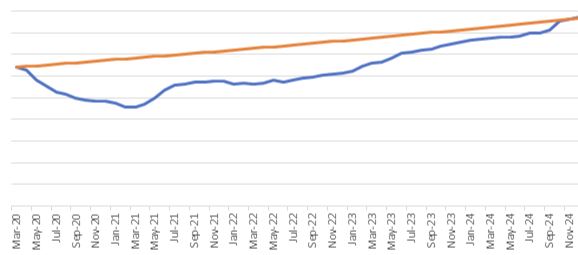

The above chart shows, portfolio wide, claims per life costs. The orange line assumes 6% inflation continues and the blue line is the actual recorded levels.

Will PMI get cheaper?

The answer is simply no. The price of a pint of milk has not started to fall because everything has caught up, it just isn’t increasing as fast.

This is largely the same for PMI.

While it obviously varies by scheme, premiums are broadly now where they need to be, so we should expect vendors to consider lowering their inflation estimates.

Underwriting is a balance of protection and competitiveness, and over the last couple of years, underwriters have had no choice but to choose protection.

We may be returning to a scenario where PMI is more of a risk than a known cost, so pricing can once again become more commercial.

What about utilisation?

It feels like utilisation skyrocketed in the last couple of years but in truth, our data suggests it has only increased on average 7% annually since 2020.

However, all the heightened activity has occurred in two years, rather than the more even spread we usually expect over five years.

The use of digital GPs may have a small part to play but we must remember, NHS GPs are no longer seeing private patients at the rate they were; therefore some referrals have simply changed source.

Additionally, members have effectively been forced into private treatment due to limited NHS provision – and are becoming savvy to using a private pathway.

What about protection benefits?

Group life assurance (GLA), was also impacted by Covid-19, with ‘excess deaths’ having a direct impact on rates.

While this has lessened in the last 12-18 months, other societal and legislative changes continue to impact premiums.

On inflation (according to the Swiss Re Group Watch Report 2025), price rises in 2024 were lower than seen in 2023.

With most group risk benefits linked to salaries, this has inevitably fed through to the amount of growth in benefit terms and the impact on in-force premiums compared with twelve months ago.

This, coupled with changes to the employer National Insurance contributions, has led to the view that budgets will continue to be reviewed (and arguably lowered).

However, in contrast to the healthcare market, the protection market has remained reasonably stable – in part due to high interest rates resulting in lower income protection costs.

Although with many economists forecasting reduced interest rates by the end of 2025, a close eye will need to be kept on the changing market.

How employers are adapting

We are seeing a shift away from a traditional comprehensive one-size-fits-all approach, to offering employees core company-funded coverage, and a choice of self-funded optional add-ons, particularly for a younger demographic that questions the value of comprehensive PMI.

For organisations that don’t have whole-of-workforce healthcare, but can see the impacts of ill health on workplace absence, traditional PMI is unlikely to be their starting point.

Hybrid options supporting everyday healthcare issues are growing in popularity, allowing for more effective budget management.

These are typically delivered digitally, reducing the burden of on-boarding.

Managing the risks

Cancer continues to be a high-risk factor influencing premiums, but changes to well established benefits can be highly emotive and difficult to navigate.

The market is developing new targeted health screening options, moving away from the old “execs only” full MOT style screenings.

As a result, we are seeing organisations showing an increased interest in both general health and lifestyle assessments, as well as cancer specific and risk management models.

Taking the rough with the smooth

Corporate deductible and corporate excess products are increasing in popularity, with the attraction of any potential surplus in a good claiming year being offset against fund in the following year.

However, these funding mechanisms aren’t straightforward, and it’s important that employers understand the implications of all the options, including master trusts and single employer healthcare trusts.

The future of workplace healthcare

Recent events have certainly resulted in more scrutiny of benefit costs overall, raising questions such as:

- Where are benefits duplicated?

- What overall value/return on investment do our benefits offer?

- How are we managing the absence risks within our business?

It’s clear that employers will increasingly play a critical role in managing the health of their workforce – but how they build and fund it is on a transformative journey.

Supplied by REBA Associate Member, Gallagher

Gallagher is a global, integrated HR consulting, benefits administration & technology services provider.