Why financial wellbeing is the biggest concern for all of your employees

Money worries are not just a low-income problem

Across the UK, an estimated 20.3 million (three out of five) workers are affected by money worries. And these worries are not just confined to the young or lower paid in the workforce.

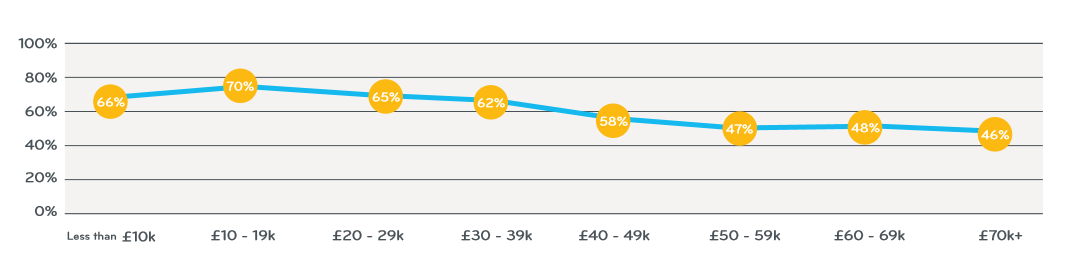

The below graph shows people in each income group who say they are affected by money worries. Although these concerns do decrease with income, almost half (46%) of employees earning over £70,000 per year are affected too, while narly half of those aged up to 64 are saying they are affected by money worries.

Our report also shows:

Our report also shows:

- 45% run out of money between pay cheques

- only one in three believe they can look forward to a good lifestyle in retirement

- One in four don’t save regularly and of those that do, the most common amount saved is less than £50 each month

- just over half (52% vs 50% last year) have to borrow money to meet basic financial needs

- for those who have debt, the average amount is £7,555, around a third of their annual salary.

Not surprisingly, financial worries are taking a toll on people. One in three employees have felt stressed, one in three have felt anxious, one in four have lost sleep and one in five have felt depressed.

However, the market is maturing...

It’s fair to say that when this journey began, and when Neyber began in 2014, financial wellbeing wasn’t a term that many employers would have recognised. But fast-forward to 2019, and 73% of employers have begun implementing a financial wellbeing strategy.

The good news is that as an industry we have realised that more needs to be done. We have moved on from "What is financial wellbeing and should we be doing it?" to "What's the best way of doing it?".

Providing support that is relevant to the differing needs of employees is an important part of an employer’s support. Financial wellbeing is not just about paying off debt, but about ensuring employees feel in control and confident about their future as well.

This year’s report reflects that shift, going beyond just the data, and takes a closer look at practical steps employers can take to meet the diverse needs of their workforce and start reaping the rewards of a well-developed financial wellbeing strategy.

To find out more download The DNA of Financial Wellbeing 2019/20 here. Now in its fourth year, this research surveyed more than 11,000 employees and 720 employers, which is a cumulative total of 42,000 people across 4 years – making it the largest study of its kind.

This article is provided by Neyber.