Better pensions data will be essential to improving pension outcomes

Pensions are high on the agenda as the government continues to set out its plans for a better system.

From greater focus on investments with the Mansion House Accord, to the reintroduction of the Pensions Commission, which aims to understand what is required to build a future-proof pensions system, pensions are having a renaissance.

As a result, the need for better pensions data will grow in the coming years as the workforce ages and more employees reach retirement with only defined contribution (DC) savings, making pensions outcomes a bigger priority.

The risk of under saving

The Institute for Fiscal Studies’ Adequacy of Future Retirement Incomes (2024) research finds that just over half (57%) of current private sector employees saving in a DC pension are projected to have an ‘adequate’ replacement income rate in retirement, based on current trends.

This highlights the need for employers to be more aware of the potential people risks associated with inadequate pension savings.

REBA’s Benefits Design 2025 research highlighted that employers are already aware of the potential risk that low contribution levels pose to both employees and the wider business – most (85%) already measure membership and pension contribution rates.

However, employers’ awareness and understanding of pensions member outcomes is much lower.

Just under one-fifth (16%) of respondents have data on pensions member outcomes, however two-thirds (66%) view this data as important or very important.

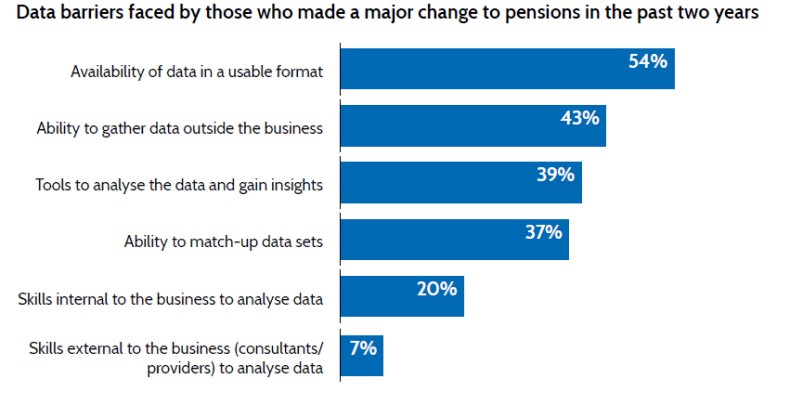

The need to address data barriers

The barriers facing employers when accessing pensions data, including the availability of data in a usable format and analytical skills, are reflected in the data employers use to seek approval for pensions change.

Nearly two-fifths (38%) of employers used pension scheme plan insights, and less than a third (29%) used return-on-investment modelling.

Most (85%) relied on external benchmarking, which is useful to ensure that employers remain competitive and compliant with legislation but is limited in its ability to forecast pension member outcomes.