The effect of mergers and acquisitions on pension plans: top considerations for employers

Pensions is a good example, but it’s an area where early action can have a big impact. With multiple parties involved, communication, collaboration, some flexibility and consistency are key.

You can’t prepare enough!

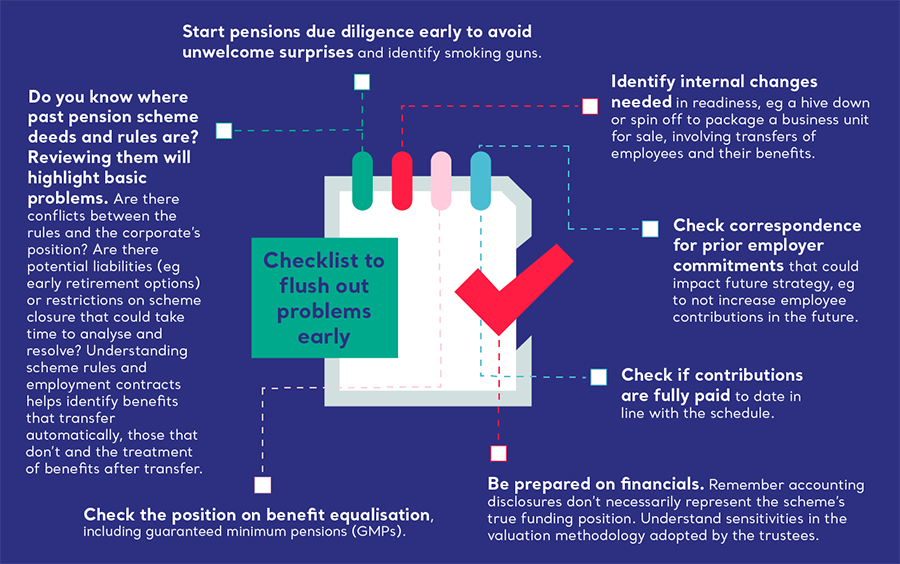

Defined benefit (DB) schemes can deter bidders and are an important element of deal pricing. Contribution requirements for poorly funded schemes can affect financial performance, capital expenditure and credit ratings. Agree a timeline and strategy upfront to reduce the risk of pension issues hampering the M&A process.

Understand your pension trustees and their role

The right trustee team and a good working relationship will smooth the process. Getting trustees involved in planning early saves time and allows pensions elements to slot into place easily.

- Identify conflicts and have protocols to manage them. If the trustee with the most relevant skills is employer nominated and/or part of the M&A team, the conflict needs managing and a replacement may be needed.

- Training for trustees and HR helps everyone understand relevant considerations, respective roles and responsibilities, and the corporate position and rationale for the transaction. Remember trustees are there to challenge the employer. Seeking advice from a professional trustee independent of your board will help you understand the trustee perspective.

- Soft skills should not be underestimated. A solutions-focused trustee who is a seasoned deal-maker or skilled mediator can support a deal process. Trustees who manage advisers effectively will drive efficiencies and those who can devote the time will help keep the deal on track.

Splitting a scheme

Many transactions involve carving up companies and schemes along business lines. Splitting pension assets and liabilities is a hefty task impacting administration, investment strategy, cashflow and much more. Even pensioners may have to be allocated to an employer and that can be painful!

Be ready to share information

Sharing commercially sensitive information with trustees and their advisers needs effective management. An non-disclosure agreement and insider list may be needed. Employers should be primed to provide detailed information about the transaction and plans for the pension scheme quickly. Ask your trustees to identify the sort of information they’ll need to take advice efficiently.

The Pensions Act 2021 brings the prospect of increased sanctions for those that fail to notify The Pensions Regulator or adequately address any material detriment to a pension scheme as a result of corporate activity. Know the regulatory requirements and take them seriously.

Expect to discuss financial repercussions on the scheme

Trustees will need to undertake a covenant review if the scheme sponsor may become financially weaker or if a value-generating entity will move further from the scheme in the new corporate structure. These can add complexity and expense, but an experienced trustee can help your finance team identify information needed and solutions to address issues.

Coordinate member communications and consultation

M&A activity can be disruptive for a workforce:

- Engage members so they know what’s coming and are reassured the transaction will not mean their pension benefits are being altered or weakened as a direct result.

- Employers and trustees should ensure messaging about pensions, the timeline, actions needed and impacts are consistent.

- Remember the basics of good communications: segment your ‘audience’; focus on clarity of key messages; and use a range of communication methods.

- Active employees need particular focus – their jobs/way of working may be impacted by corporate activity as well as their pension. If large scale job movements are anticipated, brief the scheme administrator, auditor and actuary.

- Cross-border transactions add complexity, particularly where there’s significant impact on workers’ rights. If there is a culture of industrial relations, works councils and union representatives may have rights to information and consultation that need to be respected and reflected in your communications strategy and deal timeline.

The authors are client directors Ken Potter and Louise Webb from Punter Southall Governance Services.

This article is provided by Punter Southall Governance Services.

Supplied by REBA Associate Member, Vidett

Leading the way in professional trusteeship & governance